It’s nice to get paid on time and to know you’re being paid properly for all the work that you do. Unfortunately, when it comes to medical billing, this isn’t always the case. Everything you submit doesn’t always get approved and the rules for certain MSP fee codes aren’t always clear. In fact, last year alone, our billing agents recovered almost $20 million dollars in rejected/refused claims for our clients!*

At Dr.Bill, we see a number of common mistakes when it comes to MSP billing that can cause physicians to miss out on income. Below we’ve listed 10 MSP billing tips to help you reduce rejections and optimize your claims.

1. Using Call Out & Continuing Care Premiums

If you’re called out to the hospital on an urgent, non-elective basis you can bill a Call Out (01200, 01201, 01202).

During weekdays the call must be placed prior to 8am or after 6pm. On weekends the call must be placed after 8am. If you’re called during regular weekday hours you’d bill an emergency visit instead, which covers both the visit and the surcharge.

After 45 minutes, if you’re still at the hospital and you continue to treat patients you can add the continuing care premium to your claim. You can bill non-operative continuing care surcharges (billing items 01205, 01206, 01207) for each half-hour of care provided, as long as the criteria for those fees are met.

Remember though, if you’re scheduled to be there then you aren’t eligible to bill it on routine visits or rounds.

When adding the continuing care premium to your claim make sure you leave a note with ‘CCFPP’ (Continuing Care From Previous Patient) to show that you did not leave between patients. Without this note, you’ll be deducted 30 minutes from your claim (which may be the entire time you spent with your patient). Just a reminder for those being with us, our software will automatically add this note for you.

Timing for the the continuing care premium is based on the total time spent providing continuous care, not the number of patients you see. For example, if you see 3 patients within 30 minutes then you would only add the continuing care premium on the last patient, but for the entire 30-minute duration.

Tip: continuing care will not be paid until your call out premium is paid, which means if you have any issues with your call out claim, any subsequent continuing care will be refused.

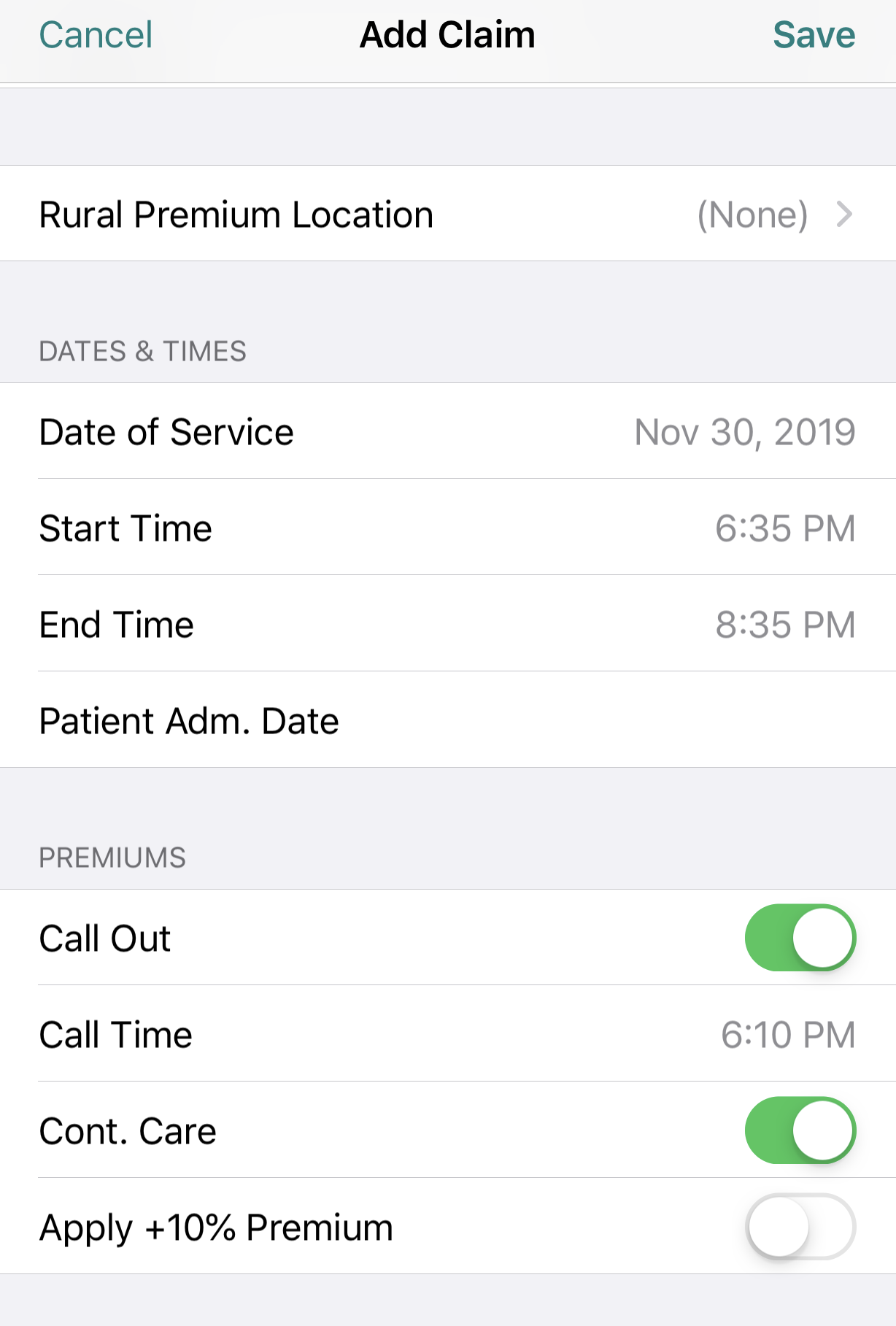

To apply these surcharges on Dr.Bill, log your consult or visit with the patient. On that claim toggle ‘Call Out & Continuing Care’. Don’t forget to enter the Call Time, Start Time & End Time for your encounter. Our app will automatically apply the correct Out of Office premiums to your claim.

2. Billing a Procedure with a Visit on the Same Day

When billing a procedure with a visit on the same day, visits should have a different diagnostic code than the procedure (if relevant). If the procedure and the visit have the same Diagnostic code then only one will be paid.

Medical billing in BC is confusing and can often be overwhelming. To help out, check out our Ultimate MSP Billing Guide that walks you through each step of medical billing – from the general Teleplan process to maximizing your claims and using mobile billing.

3. Billing a Consult with Multiple Visits

When billing a consult with multiple visits make sure you add the times of the consult and the visits. Independently this is not required, but when billed together it needs to be included so that MSP knows that the visits occurred at different times. Don’t forget to leave a note for multiple visits on the same day too (otherwise MSP will think it’s a duplicate claim).

Besides that, watch out for these 2 consult/visit mistakes we see often:

- Don’t bill more than 2 directive care codes in a week – payments for directive care are limited to two visits per patient per week (Sunday to Saturday), even when there is no interval between visits.

- Don’t log ‘out of office premiums’ on emergency visits – as these fee codes are designed to include your call out and thus are already included in the fee. Note: If you try to do this on Dr.Bill, a warning pops up to try and prevent you from making this mistake!

4. Teleconferencing out of Province

Only 10001 (urgent specialist advice – phone or in person) is covered through the reciprocal billing program. Other than that, if you’re conferencing on a patient who has health coverage outside of BC then you’re not eligible to bill teleconferencing fees.

5. Billing for Follow-Ups

If you’re following up on a patient don’t forget to bill for it. For example, if you’re a GP calling the hospital, you can bill 14077, a patient conference fee, that pays $40 per 15 minutes.

(MSP has various conference calls/follow up fee codes for most specialties.)

6. Billing for Newborns

Newborns are billable under their mom’s PHN for the first 3 months during the wait time for their own PHN is registered with MSP. For example, if born Feb.18th then you can bill them under their mom until April. However, after 3 months, remember to start billing under the infant’s own PHN to avoid rejected claims.

7. Billing for Limited Consults vs. Full Consults

A limited consultation requires all of the same components expected of a full consultation (within your specific specialty) but is less demanding and normally requires a lot less of your time than a full consultation.

Typically a full consultation is only payable once per patient every 6 months. There are also some specialties that allow a new consultation per admission (e.g. Internal Medicine Complex Patient). Whereas sometimes, you only need to provide an explanation in the notes field of the claim to let MSP know the medical necessity for the consultation within the 6 month period.

There’s no limit to how often you can log a limited consult. However, in our experience, MSP tends to reject limited consults if one has been previously logged within the last 42 days.

Generally, a limited consultation, when medically necessary or specifically requested, will be billed as part of continuing care, and a full consultation is billed for a new/complex consultation.

8. Writing off Claims

A write off should only be done when you are eligible for the claim, but due to circumstances such as invalid patient insurance, you cannot recover payment. This would qualify as a true write off that you can use for tax purposes.

Any other claims that are refused because they didn’t meet MSP’s criteria should be cancelled instead as they do not qualify as a tax write-off.

9. Avoiding Overage Claims

Submitting your claims to MSP on time is very important to ensure you get paid for the services you provide. Follow our tips to avoid lost income:

- The MSP deadline is 90 days from the date of service. We suggest submitting within 75-80 days to account for transmission time, number of days in a month, and any pre-edit refusals. That way, if there’s an error or a problem with your claim, you’ll still have time to resubmit it before the deadline.

- If a claim gets refused immediately by the MSP system (pre-edit refusal), then it has not officially been submitted. You’ll need to remedy the claim based on the refusal reason and resubmit it.

- If you’re billing with Dr.Bill, you can check the web version of your account for any refusals. These will be called “submission errors”. On our Comprehensive Plan we automatically correct and resubmit any refused claims on your behalf. If we need more information from you to do so, we’ll send you a notification.

- If claims are not submitted within the 90-day deadline, they will come back as a BV refused claim. At that point we can help you send in an ‘over-age claim request’ in an attempt to recover it. If this is the case, reach out to us and we’ll be able to provide you with more details.

10. Preventing Common Rejections

There are certain mistakes we always see – a lot of which can be avoided. The following 5 items are the most common reasons for MSP rejections:

- The location of fee code doesn’t match. For example, a radiologic fee code performed in the ER.

- There’s a fee code conflict – so assessment is required. For example, maybe you picked a fee code that’s not eligible within your specialty. Or, maybe you selected a diagnosis that is not within the list of required diagnostic codes for that fee code.

- Invalid use of premiums. For example using the continuing care premium when you’re not called into the hospital. Or logging ‘out of office premiums’ on emergency visit fee codes.

- There’s no referring physician. Most MSP claims for consultations (and some visits) require a referring physician.

- Your patient doesn’t have insurance. MSP will reject your claim if your patient doesn’t have valid health insurance.

When you do get a MSP error, it will be accompanied by a code. This code lets you know what went wrong with the claim so you know how to fix it.

MSP List of Explanatory Codes

It’s always a good idea to keep track of your rejections and make sure you’re re-submitting them so that you don’t miss out on income.

Remember that on Dr.Bill’s Comprehensive Plan, we handle all your MSP rejections for you, saving you time and helping ensure you’re paid for more of the work you do. Last year our billing agents recovered almost $20 million dollars in rejected claims for our clients!*

Have questions about your billing or how Dr.Bill works to prevent rejections and optimize your earnings? Reach out!

*2024 data based on claims recovered on Dr.Bill’s agent-supported Comprehensive and Concierge plans for rejected and refused claims.

Features that fit your practice

Our software helps you save time, collaborate with ease and get expert support.