Navigating the complexities of medical billing in Canada can feel daunting for physicians—especially if you’re new to billing. Rest assured—the rules, codes and processes might appear overwhelming initially, but with the right knowledge and tools in place, you can breeze through billing and feel more confident you’re claiming fully for your work.

Here, we’ve assembled 8 of our top medical billing tips and best practices for new and seasoned physicians alike:

1. Create a Billing Cheat Sheet

Reduce the need to constantly navigate your province’s master schedule of codes by creating a one or two-page cheat sheet for frequently used codes in your practice. Helpful information to include on a cheat sheet includes:

✅ Billing Codes

✅ Diagnostic Codes

✅ Premiums

✅ Restrictions

✅ Indirect codes (for consultations, emails, etc.)

If you practice in Ontario, B.C. or Alberta, you can also search for the codes you need by keyword in these timesaving online databases:

| Ontario | British Columbia | Alberta |

| - Billing Codes - Diagnostic Codes - Error Codes | - Billing Codes by Specialty - Rejection Explanatory Codes | - Health Service Codes - Error Explanatory Codes |

2. Submit Claims on Time

Billing regularly (daily or weekly) is recommended to ensure you don’t miss a payment cycle and maintain regular cash flow. Ministry claim submission cut-off dates vary widely. For instance, physicians in Alberta have weekly Ministry cut-off and payment dates, while physicians in Ontario have monthly cut-offs and payments.

Beyond maintaining cash flow, claims that are submitted too late may need to go through a lengthy review process or may not be eligible for payment at all (depending on your province). Most provinces have a 3-month window from the date of service until claims are considered “stale dated” or “over-age,” though some provinces, such as Saskatchewan, offer a 6-month window.

3. Bill Accurately

Billing accurately is important for ensuring you are paid fully for the work you do. Research by the CMA shows that physicians fail to bill for at least 5% of the insured services they provide (which can add up to $15,000 or more in missed billings every year!).

It is also critically important for your billing to accurately match your patient records, especially in the case of an audit.

4. Bill for Telephone Consultations

Many doctors regularly engage in phone and e-consultations, yet neglect to bill for them, which adds up to a lot of unpaid work. Generally, both the referring physician (the doctor who initiates a call) and the consultant physician (the doctor who receives the call) can bill for these consults.

Depending on your province, you may also be eligible to bill for providing advice to other registered healthcare workers such as paramedics, assisted living staff, long term care workers, public health nurses and more (when calls are initiated by the other healthcare worker). Refer to the guidelines in your province to confirm these rules and then add consult codes to your cheat sheet.

Billing Codes and Dollar Values for Telephone Consultations in Ontario | Alberta

5. Maximize Government Incentives

The Business Cost Premium in B.C. helps eligible physicians cover rising overhead costs. Rural/remote premiums in Alberta compensate physicians for practising in underserved areas. Preventive Care Bonuses in Ontario encourage primary care physicians to encourage proactive services that are likely to reduce negative health outcomes. While these are just a few examples, all provinces and territories offer incentives of some kind for sle, so contact your provincial Ministry of Health to ensure you are enrolled in all applicable programs and understand how and when to bill for them.

If you are a Dr.Bill client, we can help ensure you are taking advantage of the incentives available to you and where possible, we can set up your account so that these incentives will be billed for you automatically.

6. Add Applicable Premiums

When creating your billing cheat sheet, don’t forget to list frequently-used premium codes as well. Depending on your province and specialty, premiums can increase the value of a service provided based on elements such as service/patient complexity, physician role, time of day and length of time spent with a patient.

Premiums are an important part of ensuring you are paid accurately for your work, but are easily forgotten. That’s why Dr.Bill displays automatic alerts when premiums may apply to your claims.

7. Minimize Rejections

The process of investigating, correcting and resubmitting rejected, refused and reduced claims can become arduous for physicians. As a result, some physicians simply end up letting some or all rejections go, which can add up to a lot of lost revenue over time.

Keep our top 5 rejection-reducing tips in mind:

- Add a referring physician when applicable (it’s the most common reason for refusals!)

- Don’t forget to add the hospital admission date when billing for inpatients

- Remember to include your service location or facility code if applicable

- Avoid fee code conflicts (e.g. codes that can’t be billed together or billed under your specialty)

- Confirm coverage and patient health card details at the start of each visit

Dr.Bill users receive proactive in-app alerts before claims are submitted to prevent many of these common errors.

READ MORE: Rejection Prevention Tips for Ontario | British Columbia | Alberta

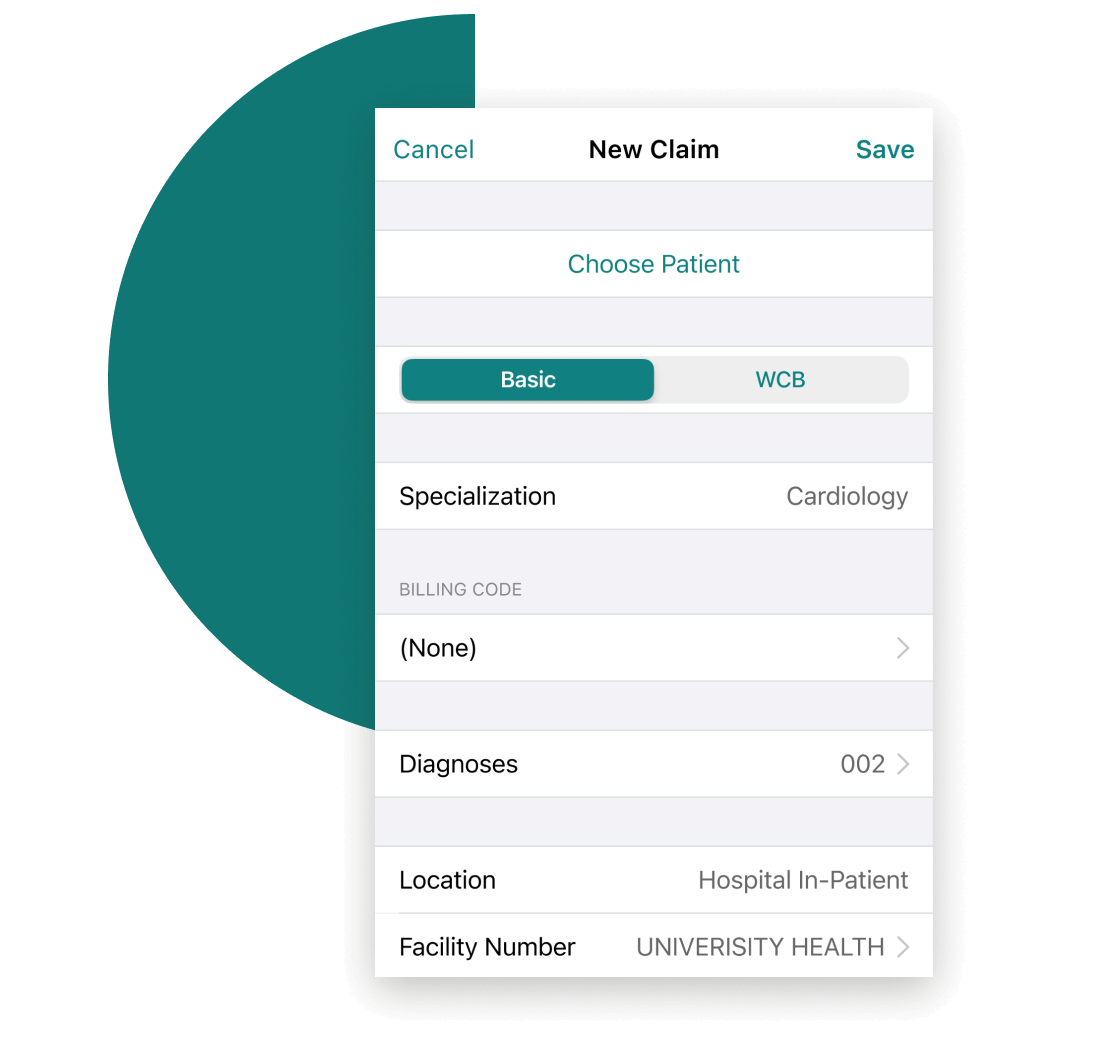

8. Choose the Right Billing Solution

The right medical billing solution for you will depend on your specialty, work setting, billing complexity and personal preference. Options range from using your EMR, outsourcing billing entirely to a billing agent or using medical billing software like Dr.Bill, backed by provincial billing specialists.

READ MORE: Top 10 Medical Billing Software Features to Look For

Want More Medical Billing Tips?

Implementing these tips can not only contribute to more streamlined billing, but more accurate billing as well.

If you have a specific question about medical billing in Ontario, British Columbia or Alberta, contact us.

Solutions Designed For The Unique Needs Of Your Practice

Get a $150 Credit when you sign up for Dr.Bill*. No credit card required.